Technicians work on the assembly line in a solar manufacturing hub in Greater Noida, on the outskirts of New Delhi India, October 23, 2024. REUTERS

Kapil Sharma, 19, technician, works on the assembly line in a solar panel manufacturing hub in Greater Noida, on the outskirts of New Delhi India, October 23, 2024. REUTERS

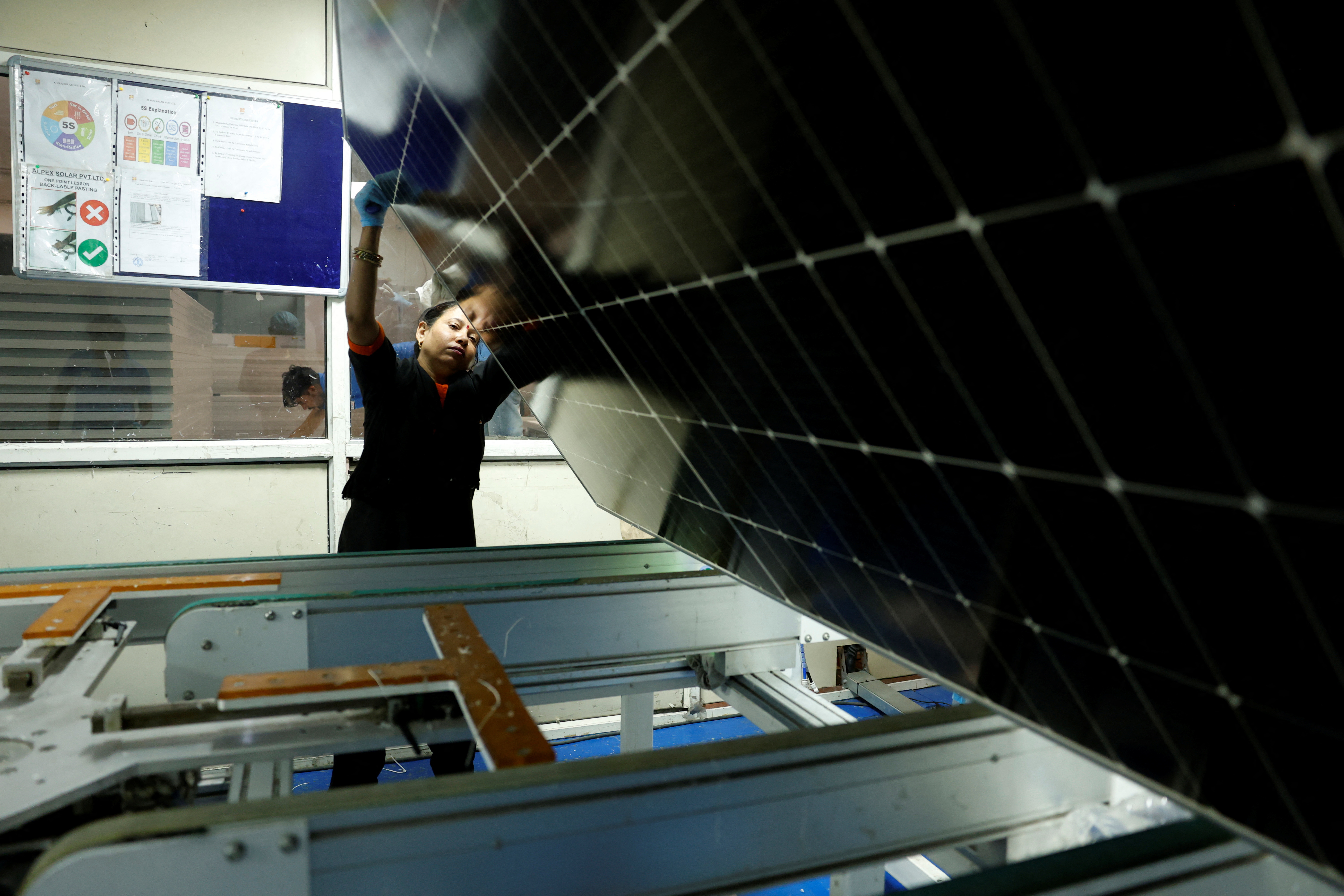

A female technician works on the assembly line at a solar panel manufacturing hub in Greater Noida, on the outskirts of New Delhi India, on October 23, 2024. REUTERS

A technician checks the machine with a flashlight at a solar panel manufacturing hub in Greater Noida, on the outskirts of New Delhi India, on October 23, 2024. REUTERS

A female technician works on the assembly line at a solar panel manufacturing hub in Greater Noida, on the outskirts of New Delhi India, on October 23, 2024. REUTERS

- Skills shortage hits firms’ expansion plans, raises costs

- India’s renewable industry faces a skill gap of 1.7 mln by 2027

- India aims to add 500 GW renewable capacity by 2030

- Industry snags cast doubts about ambitious manufacturing drive

- Industry seeks more govt support, warns of missing clean energy goal

NEW DELHI, Nov 20 (Reuters) – India’s ambitious plan to expand domestic manufacturing is coming up short in the solar industry which is grappling with inadequate government funding and a skills shortage, potentially jeopardising its clean energy targets, industry leaders said.

The hurdles faced by manufacturers of solar panels, cells and storage batteries are raising costs and delaying projects, threatening India’s ability to reduce its carbon footprint and meet international climate commitments, they said.

It also throws into sharp relief the challenges facing Prime Minister Narendra Modi’s “Make in India” program, which seeks to bolster 15 sectors, including renewable energy and electronics, in an effort to turn the South Asian nation into a global manufacturing hub.

Modi’s government has imposed 40% tariffs on Chinese solar panels and 25% on cells, allocating about $3 billion in production-linked incentives for local manufacturers as part of a plan for net zero carbon emissions by 2070.

However, industry executives say India – the world’s third-largest emitter of greenhouse gases – must significantly step up funding and training programs in the renewables sector to meet its goal of expanding non-fossil fuel capacity by 50 GW annually to 500 GW by 2030.

They caution that the absence of stronger government action could also thwart its broader manufacturing drive that has seen it plough nearly $24 billion in state incentives over five years, with another roughly 20 billion rupees set aside annually for upskilling and training.

A shortage of skilled manpower is a major problem, said Dwipen Boruah, managing director of renewables consultancy firm GSES India, which has trained over 7,000 people in renewable technologies and wants the government to substantially lift subsidies for education and training in the sector.

“Hundreds of private institutes exploit these subsidies but offer subpar training,” he said, adding that small subsidies – often just a few thousand rupees per student – hinder effective education.

Boruah and other industry executives note that while India produces over a million engineering graduates annually, traditional colleges are not equipped to teach solar, wind and other renewable technologies.

Some executives say the government’s current training budget of around 5-6 billion rupees should be ramped up by a factor of 10.

The ministry responsible for skills development didn’t respond to an email seeking comment.

Last week, Pralhad Joshi, India’s minister for renewable energy, announced the formation of a joint panel with industry representation to address key issues, including training, to meet clean energy targets.

A 1.2 MILLION PROBLEM

The renewable industry faces a skill gap of around 1.2 million, with demand expected to rise by 26% creating a need for 1.7 million skilled workers by 2027, according to TeamLease Services, a staffing company, working with industry and government on training.

“The skill gap spans all levels of industry,” especially in emerging technologies like cell manufacturing, battery storage, and advanced grid integration, said Ashwani Sehgal, president, Indian Solar Manufacturers Association.

“Industry is facing nearly 20% attrition of talented workers annually, posing a risk to production plans.”

Earlier this year, the government proposed to step up support for upskilling and relax visa restrictions on Chinese technicians, after many firms said that costly imported machines were lying unused due to a lack of skilled workers.

Vaishali Nigam Sinha, co-founder of ReNew (RNW.O), one of India’s largest renewable firms with nearly 10 GW of capacity, said skills shortage is one of the most “underestimated barriers” to energy transition.

“The lack of skilled engineers, technicians, and project managers is pushing up operational costs,” she said, a concern echoed by several industry executives.

This shortage comes as India speeds up plans for 35 GW of solar and wind capacity by March 2025, driven by a projected 7% annual increase in power demand.

Manufacturers say the skills gap could also limit India’s plans to expand solar module exports, touching $1.9 billion last fiscal year, mainly to the U.S. market.

Tata Power, with 6 GW of renewable capacity, has set up 11 training facilities, training 300,000 youth in solar installations, battery management, and other green technologies.

“A skilled workforce is essential for accelerating project deployment, ensuring efficient operations and maintenance and driving technological innovation,” said Himal Tewari, the company’s chief human resources officer.

REMOTE CHALLENGE

In Greater Noida, a manufacturing hub on the outskirts of Delhi, companies are scrambling to hire new employees.

Job ads for solar design engineers, technicians, installers and sales managers are flooding job portals, with salaries ranging from 20,000 rupees to 100,000 rupees ($239 to $1200) per month.

Monica Sehgal, director of Alpex Solar (ALPX.NS), said the company was offering incentives and overseas training in Taiwan and Vietnam to attract talent.

However, retaining workers at remote locations, particularly in Rajasthan and Gujarat, remains challenging as employees often prefer to work in bigger cities.

Kapil Sharma, a 19-year-old technician, landed a job with a hefty salary hike at the Alpex factory, on the outskirts of Delhi, after working with a company in the remote Rajasthan desert.

“I had never seen a solar panel during my three-year electrical engineering course, and received all training on the job,” he said while operating a panel manufacturing machine.

Sharma said a job in a panel factory offered higher pay compared to textile or auto factories, allowing him to send 20,000 rupees a month back home.

“I am now waiting for overseas training and higher increments.”

($1 = 84.4010 Indian rupees)

Additional reporting by Sunil Kataria Editing by Shri Navaratnam