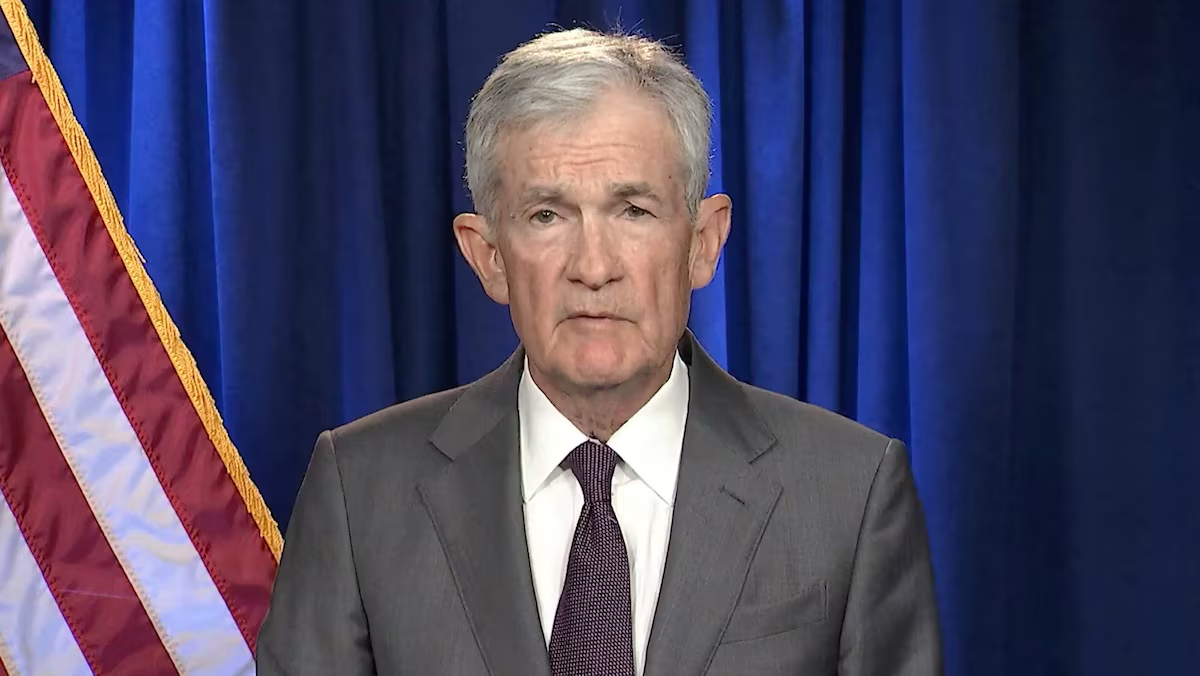

U.S. Federal Reserve Chair Jerome Powell speaks during a video message in which he states that U.S. President Donald Trump’s administration has threatened him with a criminal indictment related to the Federal headquarters renovation, in this screengrab obtained from a video released on January 11, 2026. U.S. Federal.

A look at the day ahead in European and global markets from Ankur Banerjee.

Investors are still wrapping their heads around the latest escalation in the tussle between U.S. President Donald Trump and the Federal Reserve, with Chair Jerome Powell fighting back against the effort to control the Fed and interest rates.

Growing unrest in Iran, where more than 500 people have been killed, according to a rights group, also underscored the geopolitical challenges markets are navigating at the start of 2026, keeping safe-haven assets well supported.

Markets began trade on Monday with the bombshell that the Trump administration had threatened to indict Powell over Congressional testimony he gave last summer about a Fed building renovation project. Powell says it’s a “pretext” to gain more influence over the central bank and monetary policy.

“This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions – or whether instead monetary policy will be directed by political pressure or intimidation,” Powell .

The market’s immediate reaction was to sell the dollar and take stock futures lower, although what it means for interest rates isn’t so clear. Gold prices cracked $4,600 per ounce for the first time as investors sought safety.

The news was unsettling but market reaction was measured. There were no signs of panic selling as investors await clarity on the implications to the Fed’s autonomy and where rates head in the near term.

Perhaps markets now broadly expect the Fed to kowtow to Trump and cut rates freely once the new Fed chief settles in after May when Powell’s term ends. Futures pricing still shows two rate cuts priced in for the year.

With Japanese markets closed on Monday, there was no cash trading in Treasuries in Asian hours. The focus will be on the Treasury market once London opens.

Key developments that could influence markets on Monday:

Economic event – Germany account balance for November, euro zone sentix index for January

By Ankur Banerjee in Singapore; Editing by Jacqueline Wong