Columbia, So Carolina, USA; March Madness Wilson brand basketballs ready for players warming up before tipoff of the second round NCAA Women’s Basketball Tournament game at the Colonial Life Center. Mandatory Credit: Ken Ruinard-USA TODAY Sports via Greenville

HONG KONG, Nov 19 (Reuters Breakingviews) – China’s new hobbies will be bad news for most retailers. A fad for biking, hiking, and other physical endeavors has helped companies like $10 billion Amer Sports (AS.N), tempt shoppers, and the maker of trail shoes and skis is growing sales despite a sluggish economy. But a yen for adventure won’t necessarily be a boon for other brands.

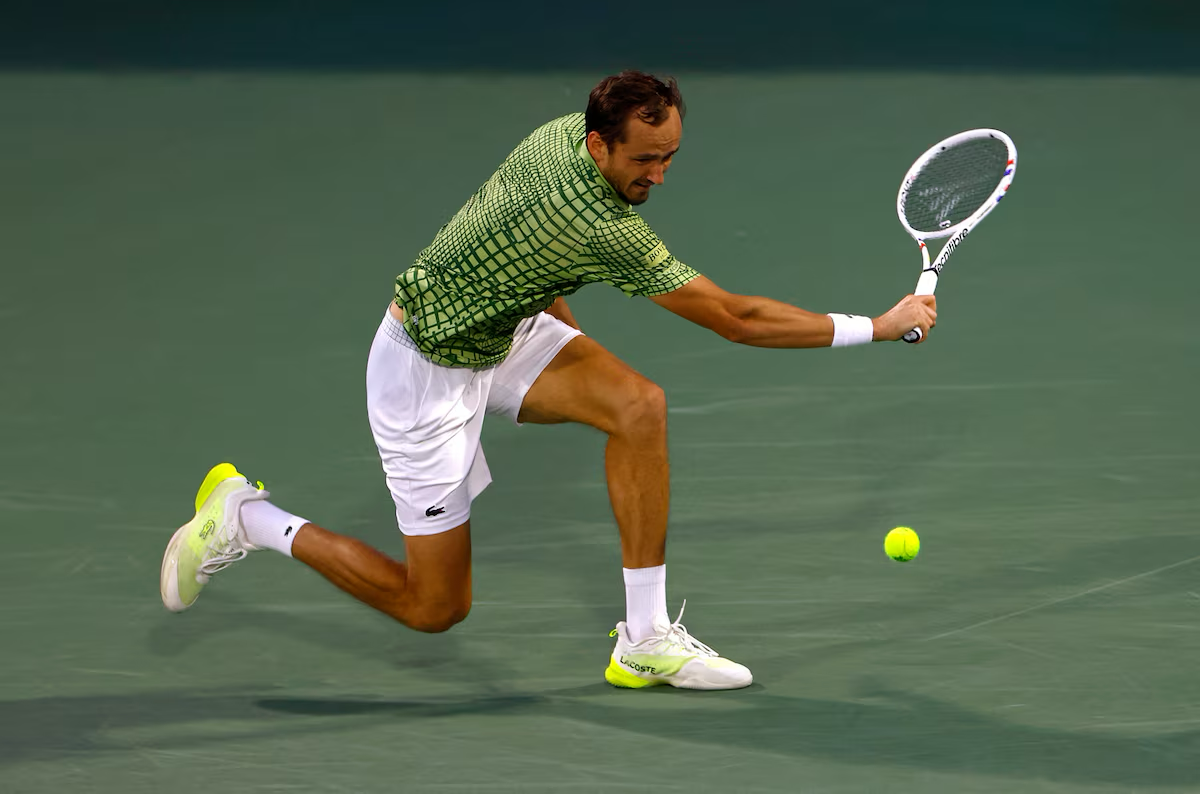

Amer, known for its Arc’teryx, Salomon, and Wilson brands, will report results for the three months to the end of September on Tuesday. Quarterly revenue from Greater China is forecast to top $280 million and account for around a fifth of the total, according to the average of analysts’ forecast collected by Visible Alpha. That puts the region’s sales growth on track to hit 40% this year – outpacing other markets. Since Amer’s New York listing in January, its shares have sprinted ahead 50% and now trade on 28 times earnings for the next 12 months, a premium to pure-play consumer stocks like LVMH (LVMH.PA) and Chinese liquor giant Kweichow Moutai (600519.SS), which both trade on 20 times.

Other outdoorsy bets are also enjoying a good run. Sales of Lululemon (LULU.O), athletic apparel, Shimano (7309.T), bike gear and Deckers Outdoor’s (DECK.N), Hoka sneakers are all climbing. Events such as marathons and even ultra-marathons are increasingly common, and popular: only 15% of applicants for the Beijing Marathon nabbed a spot last year. The market for sports clothing and footwear could expand at a compound annual growth rate of 9% between 2022 and 2027, per Euromonitor research cited in Amer’s prospectus. To compare, luxury sales in the world’s second-largest economy are forecast to fall by a fifth or more this year, according to a recent Bain & Company report.

However, overall consumer goods and services aren’t generally keeping up with niche outdoor brands. True, retail sales grew 4.8% year-on-year in October, the fastest pace since February. But government stimulus and incentives flattered the figures by temporarily boosting purchases of big-ticket items like cars and electronics, according to Tommy Wu, an economist at Commerzbank. E-commerce giants Alibaba (9988.HK), and JD.com (9618.HK), reported tepid earnings last week. Returning retail sales growth to pre-pandemic norms around 10% will be a slog.

One reason is that many shoppers now value experiences more than material acquisitions against a gloomy economic outlook. This trend also explains recent phenomena such as so-called “special forces travel” – eschewing once-popular shopping destinations like Paris or Hong Kong for domestic tourist hotspots on a minimal budget – and the rise of camping, and road trips. If that’s the trend, China’s big spenders could be more inclined to splurge on hostels and hiking poles than Louis Vuitton handbags. Some might not buy anything at all: a recent rage for nocturnal cycling, involves students spending the equivalent of a few dollars each to borrow bikes.

CONTEXT NEWS

Amer Sports, known for its Arc’teryx, Salomon and Wilson sports equipment brands, is expected to report revenue of $1.3 billion in the three months to the end of September, according to the average forecast from analysts polled by LSEG. Last year’s third-quarter results, which came prior to Amers’ stock-market listing, were not available.

The company’s revenue could reach $5 billion for the full year, up from $4.4 billion in 2023, per LSEG.

The company is scheduled to report quarterly earnings on Nov. 19.