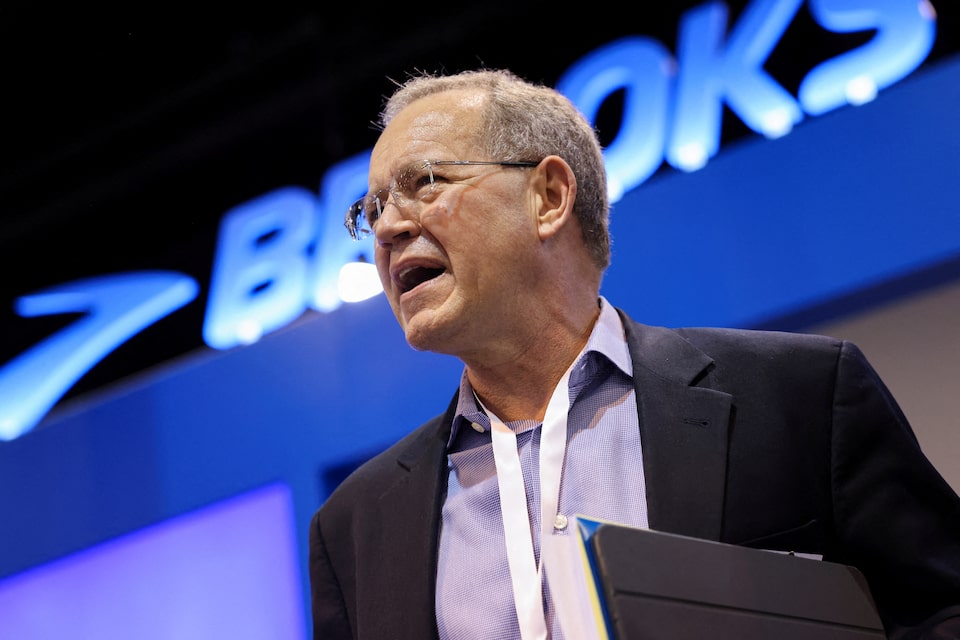

Ted Weschler, portfolio manager for Berkshire Hathaway Inc., talks to attendees at the Berkshire Hathaway Inc annual shareholders’ meeting in Omaha, Nebraska, U.S. May 3, 2024. REUTERS

Berkshire Hathaway logo is displayed on a screen on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., May 10, 2023. REUTERS

Companies

-

Berkshire Hathaway Inc

-

DaVita Inc

(Reuters) – Warren Buffett’s Berkshire Hathaway (BRKa.N), said it has sold an additional 750,000 shares of DaVita (DVA.N), reducing its stake in the kidney dialysis services provider by about 2% to 35.14 million shares worth $5.4 billion.

The sales between February 14 and 19 totaled about $115 million, according to a Wednesday night filing with the U.S. Securities and Exchange Commission.

The sales reduced Berkshire’s ownership stake in DaVita to about 44%, based on DaVita’s 80 million outstanding shares as of January 31.

The latest sales follow a sale by Berkshire of 203,091 DaVita shares back to the Denver-based company on February 11, pursuant to an agreement for DaVita on a quarterly basis to repurchase enough shares to reduce Berkshire’s stake to 45%.

It wasn’t immediately clear why Berkshire sold additional DaVita shares.

The latest selling came after DaVita’s 2025 earnings outlook on February 13 disappointed investors.

DaVita’s share price fell 11% the following day. The shares closed at $154.96 on Wednesday.

Neither Berkshire nor DaVita immediately responded to requests for comment on Wednesday after market hours.

Berkshire has owned DaVita shares since the fourth quarter of 2011.

The investment was spearheaded by Ted Weschler, who joined Berkshire as a portfolio manager in 2012 and had invested in DaVita at his former hedge fund firm Peninsula Capital Advisors.

Buffet has led Omaha, Nebraska-based Berkshire since 1965.

Reporting by Jonathan Stempel in New York; Editing by Sandra Maler and Leslie Adler