The first produced ammunition from a new filling line for artillery ammunition, known as the “screw-type filling line” at ZVS Holding, in Dubnica nad Vahom, Slovakia, December 16, 2025. REUTERS

PRAGUE, (Reuters) – Czech defence group Czechoslovak Group (CSG) is looking to expand globally, including moves into new areas like jet engines used for drones or missiles, as it prepares for what could be one of Europe’s biggest IPOs this year.

CSG’s roots were in retooling Cold War-era military gear. Its manufacturing of ammunition, military trucks, armoured vehicles and rocket launchers has made it one of Europe’s fastest-growing defence firms after tapping into aggressive military spending in the wake of Russia’s invasion of Ukraine.

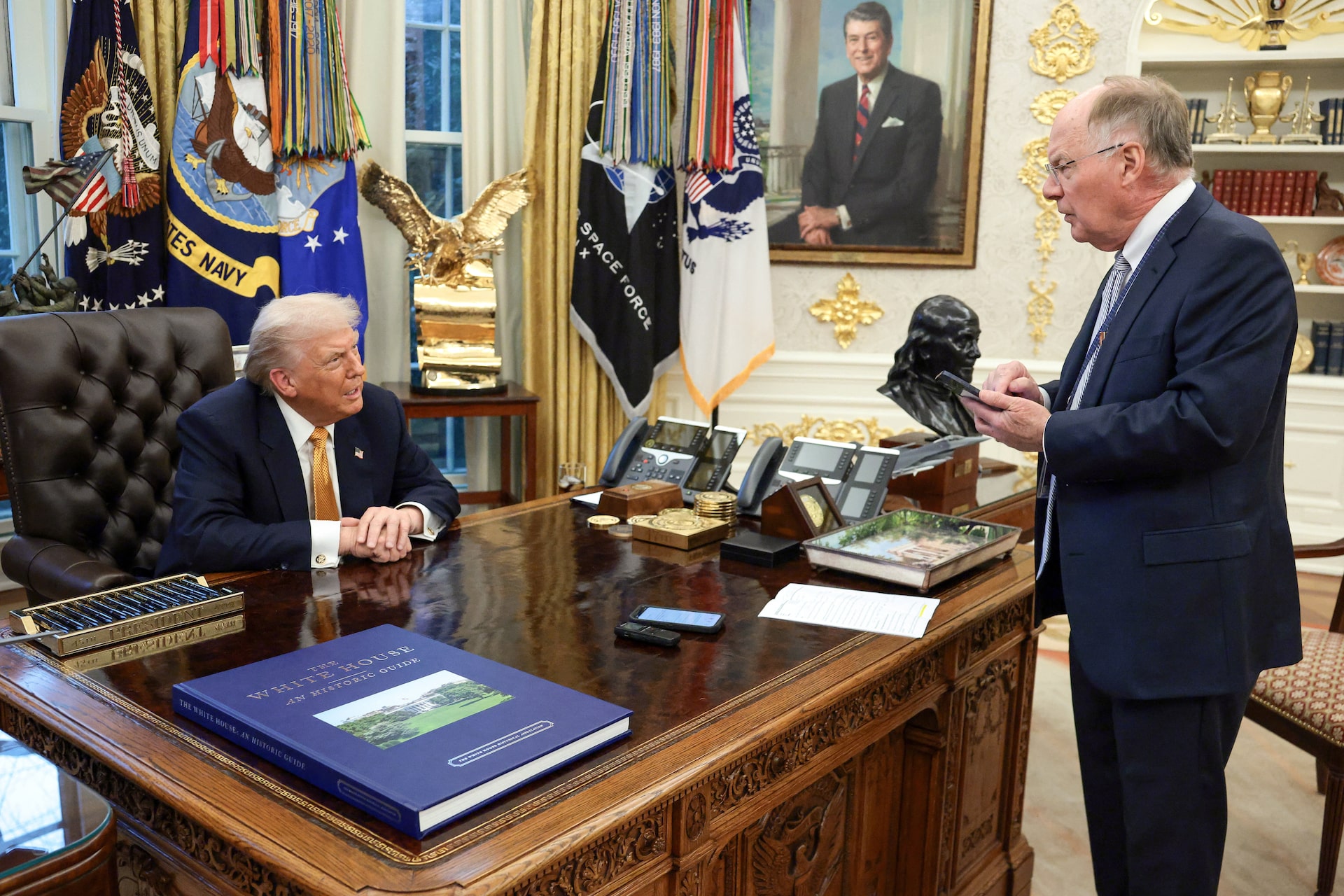

“When the war in Ukraine started, we were the first to start investing heavily,” CSG’s owner and CEO Michal Strnad told Reuters. “I took the risk and we got going.”

Strnad, 33, took over the business his father Jaroslav started in the 1990s buying Soviet-era military equipment for scrapping. He is now steering CSG towards an IPO as investors funnel billions of dollars towards defence.

Sources have told Reuters that a listing on Euronext Amsterdam could raise over $3 billion and that the IPO process could start as early as this week.

The company, which sealed a $2.2 billion deal for U.S.-based small-calibre ammunition maker Kinetic Group in 2024, is also on the lookout for more acquisitions as it seeks to become more integrated to compete with larger rivals and help control its margins.

“We will definitely be making some acquisitions,” Strnad told Reuters at CSG’s headquarters in Prague, saying the company wants to become “completely, fully vertically integrated” across its range of products.

“I don’t want to be pushed into a corner by suppliers. We don’t want to be hostages, we want to have everything under our own roof, we want to manage it, we want to be responsible for it, and of course we want to keep the margin at home.”

STRONG DEMAND, BUT CHALLENGES AHEAD

CSG faces challenges. Any peace deal for Ukraine – the source of a third of CSG’s 2024 revenue – could take away a key driver of growth, while bigger European rivals like Germany’s Rheinmetall often dominate regional defence contracts. Defence is also shifting toward drones and hypersonic missiles.

“If warfare shifts more in that direction, there’s a risk we see a peak in revenues and valuations across the sector not just for CSG,” said Jens-Peter Rieck, aerospace and defence analyst at consultancy mwb research.

Adrien Rabier at Bernstein, however, said that defence demand was “far outstripping supply at the moment” and would remain so in the years ahead.

CSG plans to conclude talks in the next few months to expand cooperation with the U.S. government to produce jet engines as part of the so-called Golden Dome Project aimed at creating an integrated air and missile defence system, Strnad said.

“We definitely want to grow here, and today we want to localise production,” Strnad said, adding the firm was looking at sites in North Carolina and Wisconsin.

CSG for now relies heavily on large-calibre ammunition and military vehicles to drive revenue. Large-calibre ammo made up nearly half of pro-forma revenue of 5.2 billion euros in 2024.

The 2024 sales revenue marked a nearly nine-fold increase from 2021, the year before the Ukraine invasion, when revenue hit 592 million euros. CSG forecasts revenue of 7.4 billion-7.6 billion euros this year and boasts an order backlog of 14 billion euros.

MAKING CSG ‘TRULY GLOBAL’

Deals have been central to CSG’s rapid growth, with investments including large-calibre ammunition in Spain, a nitrocellulose company in Germany, and a joint venture for ammunition and TNT production in Greece.

The group, which employs some 14,000 people, signed a framework deal with Slovakia’s defence ministry in December that it hopes to turn into multi-billion euro pipeline for ammunition supplies to European governments.

Strnad said he sees big potential with military customers in the small ammunition segment, with NATO states likely to restock small-calibre ammo due to empty warehouses after an ongoing restock of medium and large-calibre ammunition.

CSG has a $630 million contract in the U.S. to build a large-calibre ammo loading facility in Iowa, a $1 billion truck contract with an unnamed Asian customer and a strategic partnership with Franco-German defence group KNDS for the production of hulls for Leopard battle tanks.

“I want CSG to be truly global,” Strnad said.

Writing by Michael Kahn and Jan Lopatka; Editing by Adam Jourdan and Susan Fenton